Table of Contents

What is WACC (Weighted Average Cost of Capital)?

Weighted average cost of capital is the rate at which a company is expected to pay on average to all its stake holders including creditors and share holders.

In weighted average cost of capital, all types of capital are proportionately weighted.

Importance of WACC:

WACC is a critical financial metric used to assess a company’s cost of financing and overall investment attractiveness. It is instrumental in evaluating the feasibility of various investment opportunities and making informed financial decisions.

WACC Formula:

Our WACC calculator accounts for cost of equity and cost of debt after tax, following the WACC formula mentioned below:

Where:

WACC is the weighted average cost of capital,

Re is the cost of equity,

Rd is the cost of debt,

E is the market value of the company’s equity,

D is the market value of the company’s debt,

t is the corporate tax rate.

Cost of Equity:

Cost of equity represents the rate of return a company is expected to its equity investors.

A company uses cost of equity to evaluate the required rate of return on both internal and external projects.

Cost of equity is usually higher than cost of debt, since interest payments on debt are tax deductible and debt needs to be repaid at the end of term. While equity does not need to be repaid (represents higher risk involved) and dividend payments are not tax deductible.

How to calculate cost of equity?

There are two common methods of calculating cost of equity. CAPM (Capital Asset Pricing Model) and Dividend Capitalization Model.

1. Capital Asset Pricing Model (CAPM) Approach:

This approach is widely used to estimate the cost of equity for publicly traded companies. It considers the risk-free rate, market risk premium, and beta of the company’s stock.

Cost of Equity Formula using CAPM Approach:

E(Ri) = Rf + βi * [E(Rm) – Rf]

Where:

E(Ri) = Expected return on asset i

Rf = Risk-free rate of return

βi = Beta of asset i

E(Rm) = Expected market return

2. Dividend Capitalization Model

Dividend Capitalization Model accounts for company’s dividend payout history and expected growth rate.

Cost of Equity Formula using Dividend Capitalization Model:

Re = (D1 / P0) + g

Where:

Re = Cost of Equity

D1 = Dividends/share next year

P0 = Current share price

g = Dividend growth rate

Cost of Debt:

The Cost of Debt represents the effective interest rate a company pays on its debt. It represents the cost of raising funds through borrowing. Companies use this metric to assess the expense of servicing their debts and determine the overall impact of interest payments on their financial health.

How to Calculate Cost of Debt?

The calculation of the Cost of Debt involves two main components:

- Effective Interest Rate on Debt (Rd):

The effective interest rate on debt is the rate at which the company is expected to pay interest on its borrowings. This rate can be either the current interest rate on existing debt or the rate at which the company plans to issue new debt. - Tax Shield (1 – t):

The tax shield represents the tax advantage gained from the deductibility of interest expenses. Interest payments are tax-deductible, meaning they reduce the company’s taxable income, resulting in potential tax savings.

Cost of Debt Formula:

The Cost of Debt is calculated using the following formula:

Cost of Debt (Rd) = Effective Interest Rate on Debt (Rd) × (1 – Corporate Tax Rate (t))

Where:

- Rd = Cost of Debt (Effective Interest Rate on Debt)

- t = Corporate Tax Rate

Other than this formula. Cost of debt of a company can also be found in financial databases such as bloomberg and reuters.

How to calculate weighted average cost of capital (WACC)?

Let’s understand how to calculate wacc using the example below:

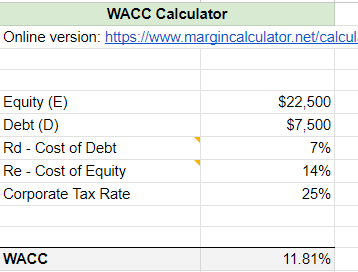

Example: Suppose we have following data of a company:

Equity (E) = $22,500

Debt (D) = $7,500

Rd = 7%

Re = 14%

Corporate Tax Rate (t) = 25%

You can calculate the WACC as follows.:

WACC Formula = (E / V) × Re + (D / V) × Rd × (1 − t)

WACC = [(22500 / 22500 + 7500) × 0.14] + [(7500 / 22500 + 7500) × 0.07 × (1 − 0.25)]

WACC = 0.1050 + 0.01312

WACC = 0.1181 or 11.81%, the WACC of the company is 11.81%.

Interpreting WACC Results:

The WACC represents the average cost of capital for the company. A lower WACC indicates that the company is raising funds at a lower cost, which can make it more attractive to investors. Conversely, a higher WACC suggests higher financial risk associated with the company’s operations.

For better understanding of company’s capital structure and cost of capital, WACC of the company should be compared with companies which have similar size in the given industry.

WACC Calculator on Google Sheet:

We have also created a WACC Calculator on Google Sheet. Click here to make a copy Google sheet – WACC Calculator