Table of Contents

What is Return on Equity?

Return on equity (ROE) could be alive of economic performance calculated by dividing earnings by shareholders’ equity. as a result of shareholders’ equity is adequate to a company’s assets minus its debt, ROE may well be thought of because the return on net assets. ROE is taken into account the life of however effectively management is employing a company’s assets to form profits.

In alternative words, this is often the company’s ability to come up with profit with the cash that shareholders have endowed. ROE is additionally called “return on net worth” (RONW).

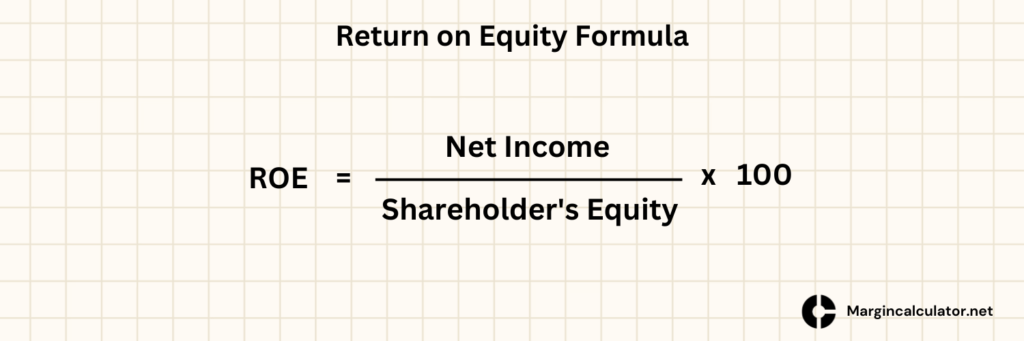

Return on equity formula:

The Return on equity formula is based on two variables – you probably have already guessed which ones. We need:

- Net Profit

- Equity

The next step is to calculate the relation between them by dividing the first one by the second, and, in the end, multiplying the result by 100% – don’t forget about this step, as ROE is always expressed as a percentage. Knowing that you probably won’t have any problems with a derivation of the return on equity formula:

Return on Equity formula:

ROE = ( Net Profit / Shareholder’s Equity ) * 100

Return on Equity can also be calculated using Dupont Formula. Dupont Formula allows in-depth analysis of components of ROE.

Dupont formula:

ROE can even be calculated at completely different periods to match its modification in worth over time.

By comparing the change in ROE’s growth rate from year to year or quarter to quarter, for example, investors can track changes in management’s performance.

How to calculate return on equity?

ROE is expressed as a percentage and can be calculated for any company if net profit and equity are each positive numbers.

Net income is calculated before dividends paid to common shareholders and once dividends to most popular shareholders and interest to lenders.

Net Income is that the quantity of financial gain, net of expense, and taxes that a corporation generates for a given amount.

Average Shareholders’ Equity is calculated by adding equity at the start of the amount.

The beginning and finish of the amount ought to coincide therewith that cyberspace financial gain is earned.

Net income over the last full twelve month, or trailing twelve months, is found on the profit-and-loss statement a total of monetary activity over that amount.

Shareholders’ equity comes from the record of a running balance of a company’s entire history of changes in assets and liabilities.

It is thought of the most effective follow to calculate ROE supported average equity over the amount attributable to this couple between the 2 money statements.

Calculation:

Now, let’s have a look at how it works in practice. Imagine a company with the following parameters:

Net Profit: $33,500

Equity: $453,000

What will the value of ROE be in this case?

ROE = 33,500 / 453,000 * 100% = 7.40%

What is a good return on equity?

The value of ROE should be as high as possible. The higher the ROE of a company, the firmer and more beneficial its situation on the market. Apparently, the best value of ROE is about several dozen percent, but such a level is difficult to reach and then to maintain. A good return on equity is much lower. Economists say that it is about 10-15% – such value is supposed to be likely to keep.

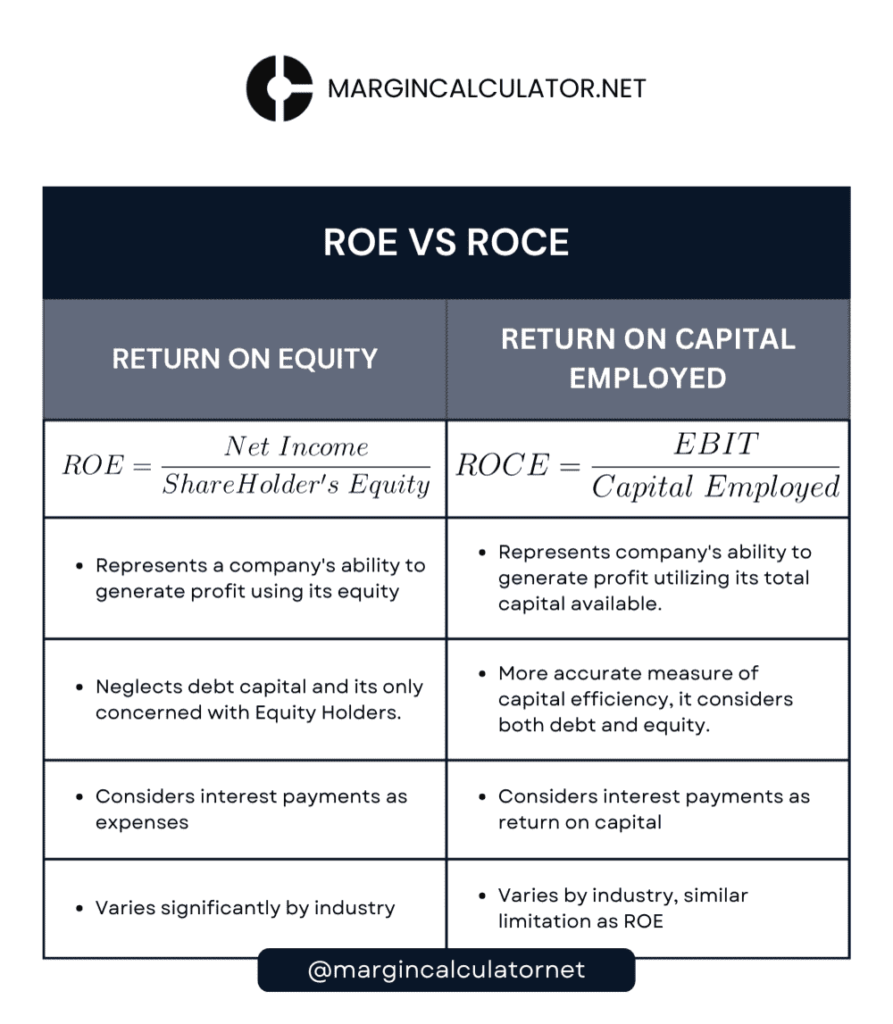

Return on equity vs return on capital:

The problem for many people is to notice the differences between indicators which seem to be similar. That’s why we have made a quick comparison return on equity vs return on capital as they are close to each other.

ROCE (return on capital employed) is a ratio that indicates the profitability of the investment in which the whole employed capital of a company is engaged. As opposed to ROE, ROCE considers not only the equity but also liabilities. Thanks to this fact, it is more useful when we want to analyze a company with long-term debt.

Importance of ROE:

ROE is more than a measure of profit. A rising ROE suggests that a corporation is increasing its ability to get profit with no need for the maximum amount of capital.

It also indicates how well a company’s management is deploying the shareholders’ capital.

In alternative words, the upper the ROE the better. falling ROE is usually a problem.

However, it’s necessary to notice that if the worth of the shareholders’ equity goes down, ROE goes up.

Thus, write-downs and share buybacks can artificially boost ROE.

Likewise, a high level of debt will by artificial means boost ROE; in spite of everything, the additional debt a corporation has, the fewer shareholders’ equity it’s (as a proportion of total

assets), and the higher its ROE is. Some industries tend to possess higher returns on equity than others. As a result, comparisons of returns on equity square measure usually most substantive among corporations at intervals a similar trade, and also the definition of a “high” or “low” quantitative relation ought to be made within this context.

Further Reading:

https://www.investopedia.com/terms/d/dupontanalysis.asp

https://www.investopedia.com/terms/r/returnonequity.asp

https://www.investopedia.com/terms/o/operationalefficiency.asp