Table of Contents

What is IRR?

The IRR is a financial metric used in capital budgeting and investment analysis. It represents the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. This includes both the initial investment cost (outflow of cash) and the projected future cash inflow.

In essence, the IRR is the break-even discount rate (see Graph 1 below), at which the money you spend on the investment today would equal the money that investment makes for you in the future, when adjusted for the time value of money (the idea that money available now is worth more than the same amount in the future due to its potential earning capacity).

If the IRR of a venture exceeds your required charge of return, the project is normally considered a very good investment, and vice versa. However, IRR is not the ultimate deciding factor in investment appraisal process, it has its own limitations.

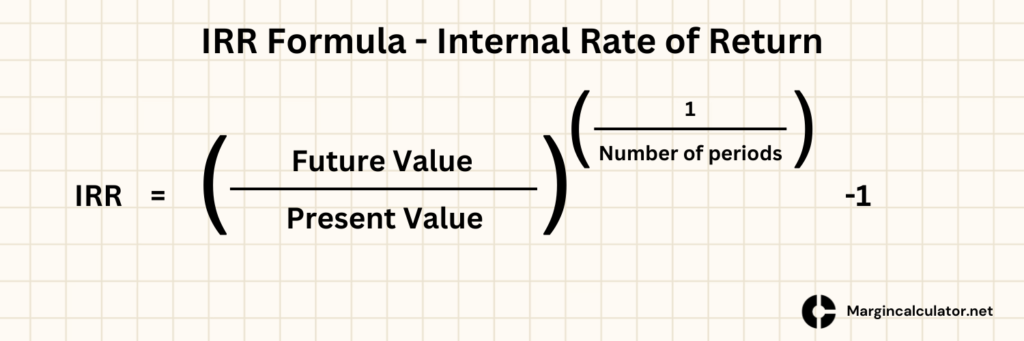

Internal Rate of Return Formula (IRR):

Internal Rate of Return (IRR) = (Future Value ÷ Present Value)^(1 ÷ Number of Periods) – 1

This formula helps us identify the rate of discount (r) that results in Net Present Value (NPV) of all future cash flows to be null / zero.

Alternatively the formula can represented as follows:

NPV = ∑ (CFt / (1 + r)^t) = 0

In this formula:

- NPV represents the Net Present Value of all cash flows.

- CFt represents the cash flow in year t.

- r represents the Internal Rate of Return (IRR).

- t represents the time period, with t = 0 for the initial investment.

In practice, this formula is solved iteratively using numerical methods or financial software because finding the exact IRR can be a complex mathematical problem, especially for projects with multiple cash flows.

IRR in Excel:

If you need to calculate IRR in Excel. Checkout this step by step tutorial by trumpexcel.com.

Also checkout this video to learn how to calculate IRR in Excel