Table of Contents

What is EBIT?

Earnings Before Interest and Taxes which is also referred as EBIT is a measure of the profitability of a company that incorporates all the incomes and expenses without interest and income tax expenses. It is an indicator that demonstrates the profitability of a company. It is also referred to as operating income because you can find this amount after deducting all the operating expenses from sales revenue such as production and non-production cost.

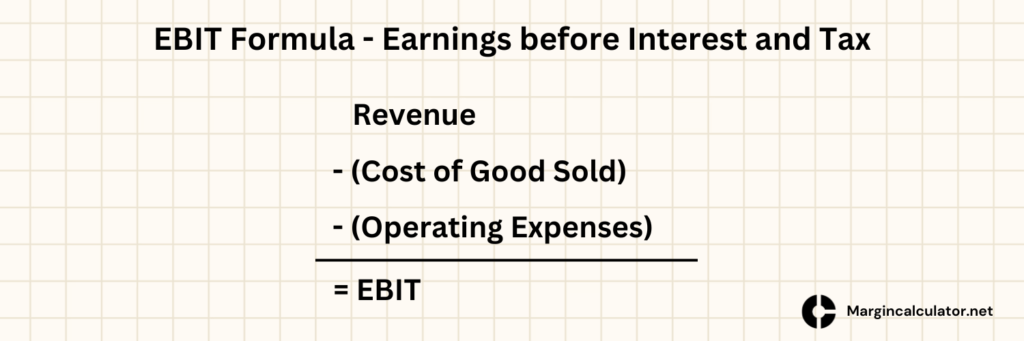

EBIT Formula:

EBIT = Revenue – Cost of Goods Sold – Operating Expenses

How to calculate EBIT?

Calculating EBIT involves a simple and direct approach, as well as an indirect method. Let’s explore both methods to derive the EBIT formula.

Direct Method:

The direct method involves subtracting the cost of goods sold (COGS) and operating expenses from the total revenue. Here’s the EBIT formula using the direct method:

EBIT = Revenue – Cost of Goods Sold – Operating Costs

Indirect Method:

The indirect method starts with the company’s net income and adds back interest expenses and taxes. The formula using the indirect method looks like this:

EBIT = Net Income + Interest Expenses + Taxes

It’s important to understand the concept of EBIT as it provides insights from two different perspectives. The direct formula shows what is deducted from the company’s profit to arrive at EBIT, while the indirect formula demonstrates what needs to be added back to net income. Both formulas yield the same result, but they offer distinct viewpoints – one from a basic operations perspective and the other from a year-end profitability standpoint.

Including Interest Income:

In certain cases, investors may choose to include interest income in the EBIT calculation. For example, if interest income is a significant source of revenue for a company, investors might opt to include it even if it is part of operating activity. For instance, consider Ford Motor Company – they manufacture vehicles and provide financing, so their interest income must be included in the calculation.

Presentation in Financial Statements:

While calculating EBIT is not mandated by the GAAP (Generally Accepted Accounting Principles), some financial statements include it as a subtotal. This approach helps investors comprehend the earnings from operations and compare them to taxes and interest expenses.

EBIT Example:

To better understand EBIT calculation, let’s look at an example:

Ron’s Lawn Care Equipment and Supply Company manufactures tractors for commercial use. Here are the figures from Ron’s income statement for the year:

- Sales: $1,000,000

- Gross Profit: $350,000

- COGS: $650,000

Using this data, we can calculate the Earnings Before Interest and Taxes (EBIT) using the direct method:

EBIT = $1,000,000 – $650,000 – $200,000

EBIT = $150,000

In this example, Ron’s Lawn Care Equipment and Supply Company has an EBIT of $150,000 for the year. This means that after accounting for the cost of goods sold and operating expenses, the company generated $150,000 in profits available to cover taxes, interest expenses, debt, and shareholder returns. EBIT is a valuable metric to assess a company’s operational profitability and financial health.

EBIT vs EBITDA

EBIT is the operating profit of an organization without interest cost and taxes. While EBITDA takes EBIT and strips out amortization and depreciation costs to calculate profit. Similar to the EBIT, EBITDA also excludes interest expenses and taxes on debt.

For the organization with a lot of fixed resources, they can devalue the cost of purchasing those assets over their valuable life. In other words, we can say that depreciation enables an organization to spread the expense of an asset out over numerous years or the life of the asset. Depreciation spares an organization from recording the expense of the asset in the year the asset was purchased. In this case, depreciation cost decreases profitability.

For the organization with a lot of fixed resources, depreciation cost can also affect net income or the primary concern. EBITDA estimates an organization’s profits by clearing depreciation. Therefore, EBITDA penetrates down to the profitability of the operational performance of an organization.

EBIT vs Operating Profit

Most of the people get confused between the terms of accounting. They correlate or differentiate some of the terms with each other that sometimes are not different or the same with each other. Similarly, people think that EBIT and Operating Profit are different from each other, but in actual, they are the same. Earning Before Interest and Taxes (EBIT), Operating Profit and Operating Income are the same things with different names. They all have the same meaning and used for the same purposes.

EBIT vs Gross Profit

EBIT (Earnings Before Interest and Taxes) and Gross Profit are two crucial metrics used to assess a company’s financial performance. While Gross Profit focuses on the efficiency of production and the revenue generated from core business activities, EBIT provides a broader view of operational profitability, considering both production costs and operating expenses while excluding interest and taxes.

Both metrics offer valuable insights, but EBIT is especially valuable as it allows investors and analysts to assess a company’s operational performance without being impacted by financial and tax considerations. By understanding these metrics, stakeholders can make more informed decisions about the company’s overall financial health and potential for growth.

EBIT Margin

An EBIT Margin is the operating profit over operating sales. This margin enables investors to understand genuine business expenses of running an organization, since parts of an organization’s property, equipment and plant will need to be replanted as they get utilized, broken down or rotted.

The lower EBIT Margins demonstrate lower profitability from an organization. When looking at its competitors, investors can decide whether lower EBIT margins are because of the competitive landscape where all the organization are having lower margins or an issue just inside the organization where the organization is confronting with higher expenses and lower sales.

Resources to Learn more:

- Investopedia – Earnings Before Interest and Taxes – EBIT

- AccountingTools – The difference between EBIT and EBITDA

- Investopedia – Operating Profit